Generally, however, to qualify to file or e-File as a Head of Household, you have to be unmarried and you have to support a dependent or qualifying relative. Additionally, other unmarried people and, with some exception, legally married people with dependents might qualify as Head of Household.

INCOME TAX BRACKETS 2020 HEAD OF HOUSEHOLD FREE

Many singles with dependents qualify as Heads of Household - use this free DEPENDucator to see who you can claim on your 2020 Return.

INCOME TAX BRACKETS 2020 HEAD OF HOUSEHOLD HOW TO

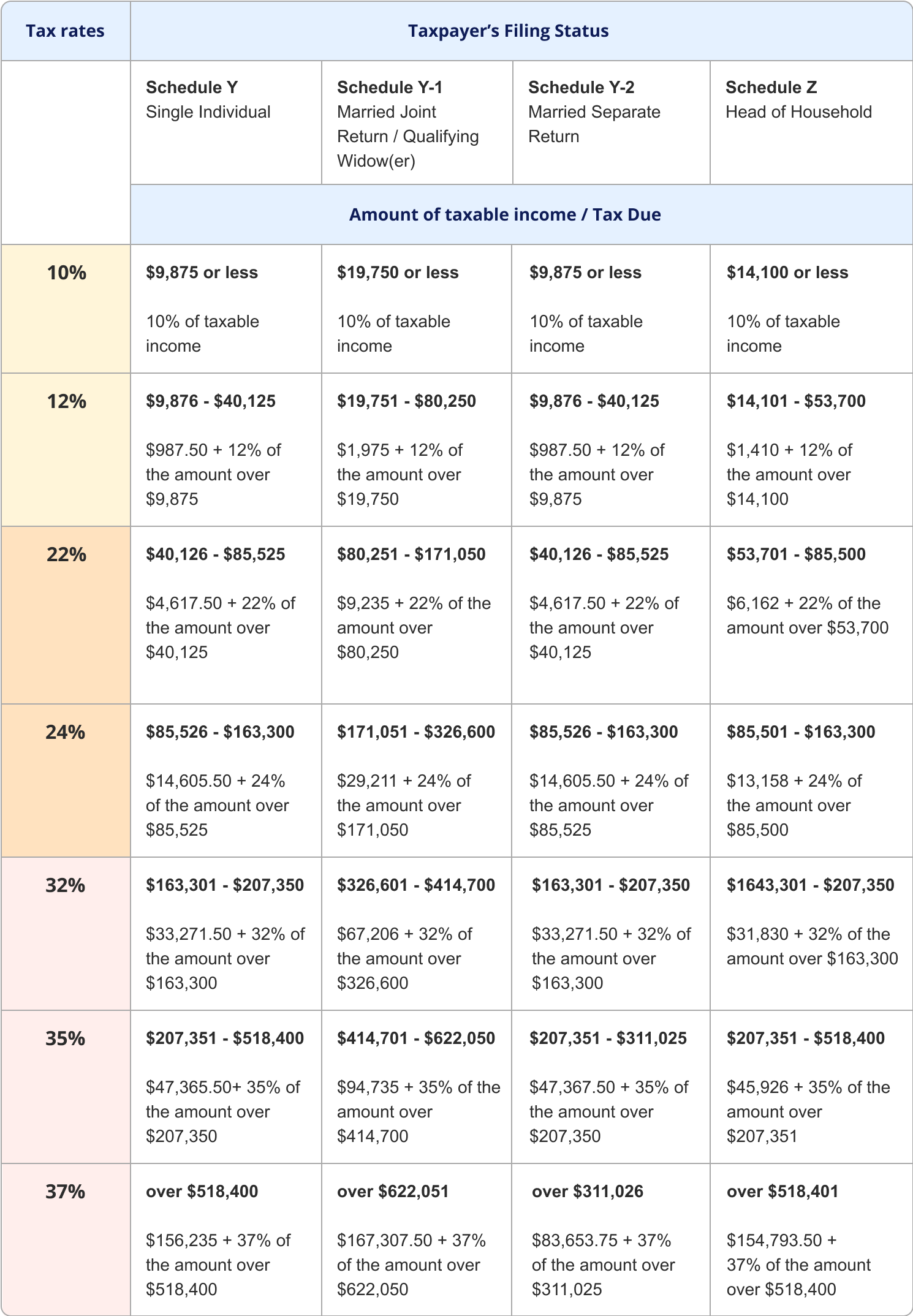

It's a great tax return filing status that can pay off when you e-File your tax return! How to Qualify as Head of HouseholdĪttention: Compared to the single filing status, the Head of Household filing status will get taxpayers get lower tax rates and a higher standard deduction, plus qualify more easily for tax credits. but the HOH we're talking about is a Head of Household. Is a HOH someone who dates everyone but you? Something Santa Claus says three times? Is it a river named after a Native American tribe? How about an expression commonly used after "Heave?" e-File your taxes on each year so you do not have to worry about handling complicated IRS AND state forms. You can only prepare and e-file a return in the tax season it is due. Start and sign up now and be part of the Tax Win Zone. Below are the latest State tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator.The tax season for a given tax year begins in January following that year. State Tax Tables are updated annually by the each States Tax Administration Office. You can also find supporting links to the State Tax tables for each State linked from the Federal Tax Tables or select the current year State Tax Tables from the State list further down this page. Federal Tax Tablesīelow are the tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator. You may also be interested in using our free online 2020 Tax Calculator which automatically calculates your Federal and State Tax Return for 2020 using the 2020 Tax Tables (2020 Federal income tax rates and 2020 State tax tables). Then Taxable Rate within that threshold is:Ģ020 Federal Income Tax Rates: Married Individuals Filling Joint Returns If Taxable Income is:Ģ020 Federal Income Tax Rates: Married Individuals Filling Seperately If Taxable Income is:Ģ020 Federal Income Tax Rates: Head of Household If Taxable Income is:Ģ020 Federal Income Tax Rates: Widowers and Surviving Spouses If Taxable Income is: 2020 Federal Income Tax Rates: Single Individuals If Taxable Income is: The Income Tax Rates and Thresholds used depends on the filing status used when completing an annual tax return.

You will also find supporting links to Federal and State tax calculators and additional useful information to assist with calculating your tax return in 2020 2020 Federal Income Tax Rates and Thresholdsįederal Income Tax Rates and Thresholds are used to calculate the amount of Federal Income Tax due each year based on annual income. This page provides detail of the Federal Tax Tables for 2020, has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state tax tables for 2020. The Internal Revenue Service (IRS) is responsible for publishing the latest Tax Tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year.

0 kommentar(er)

0 kommentar(er)